Why is Bitcoin’s value consistently rising?

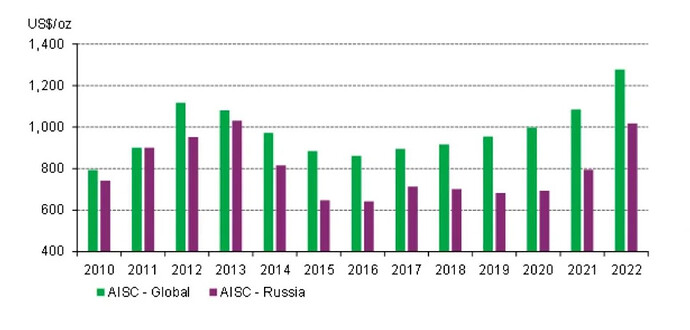

Satoshi was correct: the production cost of a commodity influences its price. Looking at gold’s AISC (All-In Sustaining Cost) and Bitcoin’s price, we see similar peaks in 2012 and 2022 and lows in 2016. After a halving event, Bitcoin’s production cost doubles because the amount of Bitcoin produced is halved—so if the current cost is $35k, it becomes $70k post-halving. This creates a situation where Bitcoin can be bought at a 50% discount on the market if the price remains at $35k while production costs are $70k.

As a result, demand surges to buy Bitcoin at $35k, pushing the price up to close the gap at $70k. Unlike gold, which can see its supply increase with higher prices (due to new mines opening), Bitcoin’s supply is fixed. The asset’s value is tied to its production cost, driving its market price higher. This dynamic, combined with fear of missing out (FOMO) and speculation, ensures Bitcoin’s long-term price rise.

Satoshi used gold production costs to illustrate difficulty adjustments, and this comparison helps us understand Bitcoin’s halving mechanism and the subsequent price increase.

So why does Bitcoin continue to trend upward? The difficulty adjustment is key. It ensures that when Bitcoin’s price falls below production costs, the protocol’s difficulty decreases, encouraging miners to operate more efficiently. This adjustment increases production costs, which in turn drives the price up.

After reading this, ask yourself: How could this mechanism not cause Bitcoin’s fair value to trend upward indefinitely? If you think it’s inevitable, consider buying and holding Bitcoin without hesitation.